All Categories

Featured

Table of Contents

That means having an emergency fund in position, a convenient degree of financial debt and preferably a diversified portfolio of financial investments. Your crypto investments can end up being one even more part of your profile, one that helps increase your complete returns, with any luck. Pay attention to these five other things as you're beginning to invest in cryptocurrencies.

Plan to do the very same with any kind of cryptocurrencies, since there are literally thousands of them, they all function in different ways and new ones are being developed every day. You require to recognize the investment instance for each profession.

That holds true for Bitcoin, for example, where capitalists rely exclusively on somebody paying extra for the property than they spent for it. To put it simply, unlike stock, where a company can expand its revenues and drive returns for you in this way, lots of crypto possessions must rely upon the marketplace becoming much more confident and favorable for you to benefit.

If your financial investment is not backed by a property or cash flow, it can finish up being worth nothing. A mistake that lots of brand-new financiers make is looking at the past and theorizing that to the future.

How To Build A Crypto Investment Strategy

The costs of cryptocurrencies are about as unstable as a property can obtain. That can be fantastic for sophisticated investors who can perform professions rapidly or who have a solid understanding on the market's basics, just how the market is trending and where it might go.

Volatility is a ready high-powered Wall Street investors, each of whom is trying to outgun various other deep-pocketed financiers. A new capitalist can conveniently obtain crushed by the volatility. That's due to the fact that volatility cleans investors, specifically newbies, that obtain frightened. Various other traders might tip in and get on the affordable.

As a more recent investor, you'll require to comprehend just how ideal to handle danger and establish a process that helps you reduce losses. And that process can differ from specific to individual: Risk administration for a long-lasting financier might simply be never offering, despite the cost. The long-term attitude allows the capitalist to stick to the placement.

The investor after that purely adheres to the guideline to ensure that a reasonably little decline does not come to be a crushing loss later on. Newer investors need to think about establishing aside a certain amount of trading money and after that using only a part of it, at least initially. If a position moves versus them, they'll still have money aside to patronize later on.

Comparing Crypto Trading Bots For Beginners

Maintaining some money in get means you'll constantly have a bankroll to fund your trading. It is essential to manage danger, however that will come with an emotional cost. Selling a losing position injures, yet doing so can aid you avoid worse losses later on. Finally, it's essential to stay clear of putting money that you need right into speculative possessions.

Whether it's a deposit for a residence or a crucial upcoming purchase, money that you need in the next couple of years need to be kept in secure accounts so that it's there when you need it. And if you're searching for an absolutely sure return, your best alternative is to settle high-interest financial obligation.

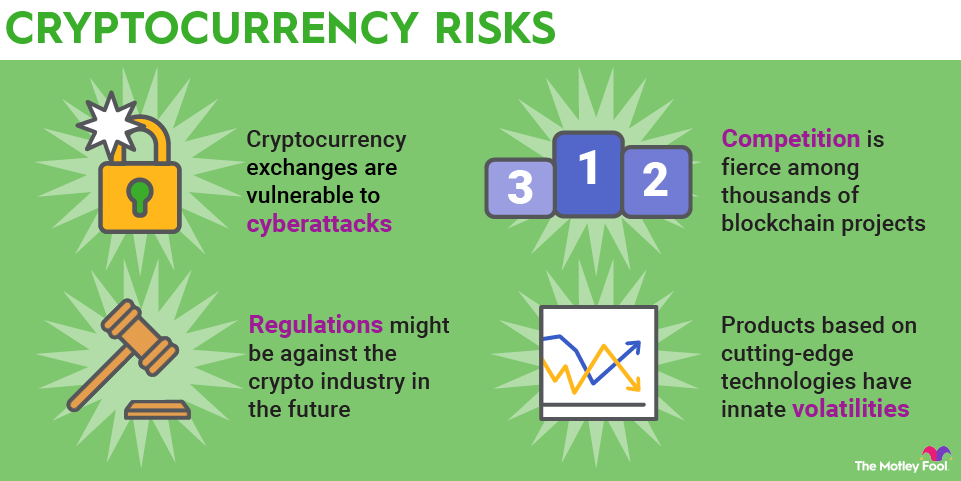

You can not lose there. Don't forget the protection of any type of exchange or broker you're using. You may possess the possessions legitimately, but someone still needs to protect them, and their safety and security requires to be limited. If they do not believe their cryptocurrency is correctly safeguarded, some investors pick to invest in a crypto purse to hold their coins offline so they're inaccessible to cyberpunks or others.

These consist of: Futures are another method to bet on the price swings in Bitcoin, and futures permit you to make use of the power of take advantage of to produce massive returns (or losses). Futures are a fast-moving market and aggravate the already unpredictable actions in crypto. In January 2024, the Securities and Exchange Commission accepted several exchange-traded funds that invest straight in Bitcoin.

How To Profit From Crypto Arbitrage Trading

So these ETFs can be an easy means to purchase crypto through a fund-like item. Buying supply in a business that's poised to make money rising of cryptocurrency no matter of the victor could be a fascinating alternative, as well. And that's the potential in an exchange such as Coinbase or a broker such as Robinhood, which derives a big chunk of its revenues from crypto trading.

Numerous supposed "complimentary" brokers embed costs called spread mark-ups in the cost you pay for your cryptocurrency. The best method to think of a blockchain is like a running invoice of deals - Non-Fungible Tokens.

Many crypto blockchain data sources are run with decentralized computer networks. Some cryptocurrencies compensate those who confirm the purchases on the blockchain data source in a procedure called mining.

A Beginner’s Guide To Crypto Trading

, yet there are essentially loads of others. Numerous traditional brokers likewise enable you to trade Bitcoin in addition to stocks and various other financial possessions, though they have a relatively limited option of various other cryptocurrencies.

As payment apps such as PayPal, Venmo and Cash Money App. If you're looking to acquire Bitcoin, pay specific focus to the charges that you're paying. An altcoin is an alternate to Bitcoin.

Cryptocurrency Staking: A Guide To Earning Passive Income

Currently with a reported 15,000 or even more cryptocurrencies in presence, it makes less sense than ever before to define the market as "Bitcoin and after that whatever else." Cryptocurrency is a very speculative location of the marketplace, and several clever financiers have determined to put their money in other places. For beginners that wish to obtain started trading crypto, however, the most effective suggestions is to begin little and only usage money that you can manage to lose.

Content Disclaimer: All capitalists are recommended to perform their very own independent research study right into investment approaches before making a financial investment choice. In enhancement, capitalists are recommended that previous financial investment item performance is no assurance of future price admiration.

How To Avoid Crypto Market Manipulation

Cryptocurrencies often tend to be a lot more unpredictable than even more typical financial investments, such as stocks and bonds. A financial investment that's worth thousands of dollars today could be worth only hundreds tomorrow.

Latest Posts

How To Trade Cryptocurrencies Using Technical Analysis

Top Cryptocurrency Wallets For Maximum Security

The Impact Of Bitcoin Halving On The Market