All Categories

Featured

Table of Contents

Fraudsters pose online as billionaires or popular names that guarantee to multiply your investment in a virtual currency yet instead steal what you send out. They may additionally make use of messaging apps or chatroom to start rumours that a renowned businessperson is backing a particular cryptocurrency. Once they have actually motivated financiers to purchase and increased the price, the fraudsters offer their stake, and the currency decreases in value.

Cryptocurrencies are typically constructed utilizing blockchain technology. Blockchain describes the means deals are recorded right into "blocks" and time stamped. It's a fairly complex, technological process, but the outcome is an electronic journal of cryptocurrency deals that's tough for hackers to damage. On top of that, deals need a two-factor authentication process.

While safety and securities are in area, that does not mean cryptocurrencies are un-hackable. Several high-dollar hacks have cost cryptocurrency startups heavily.

This can develop wild swings that create considerable gains for investors or large losses. And cryptocurrency financial investments go through far less regulative protection than conventional financial products like stocks, bonds, and mutual funds. According to Customer Information, all financial investments carry risk, yet some professionals think about cryptocurrency to be one of the riskier financial investment choices available.

Why Crypto Prices Are So Volatile

Prior to you spend, learn more about cryptocurrency exchanges. It's approximated that there more than 500 exchanges to choose from. Do your research, checked out reviews, and talk with more experienced investors prior to moving on. If you buy cryptocurrency, you have to save it. You can maintain it on an exchange or in an electronic pocketbook.

Diversification is key to any type of excellent investment technique, and this holds real when you are spending in cryptocurrency. Don't place all your cash in Bitcoin, for instance, just because that's the name you know.

If your financial investment portfolio or mental health and wellbeing can't manage that, cryptocurrency might not be a wise option for you. Cryptocurrency is all the rage right now, yet bear in mind, it is still in its relative early stage and is taken into consideration highly speculative.

One of the ideal ways you can remain safe online is by making use of a comprehensive anti-virus. Kaspersky Web Safety. Proof of Work protects you from malware infections, spyware, information theft and safeguards your on the internet payments making use of bank-grade encryption

How To Report Cryptocurrency Gains For Taxes

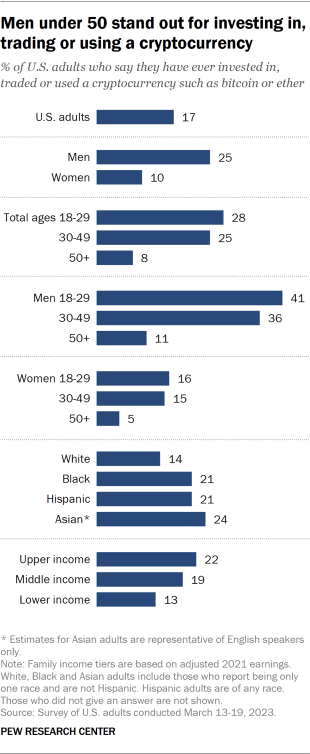

There are additionally findings in cryptocurrency pertaining to conjecture, insider trading, and rate control (Feng et al., 2017; Lion & Shams, 2020). Nevertheless, attributes connected to investors taking part in cryptocurrency still need to be checked out (Hackethal et al., 2022). One of the reasons for the lack of research in this location is privacy followed in cryptocurrency transactions, as individuals can get, hold and market these money without having a link to a typical checking account.

Modern monetary concepts assume that investors are logical and make financial choices rationally. Nevertheless, the assumption of investors being reasonable has recently been examined, and the literature has proof of financiers choosing based upon behavior biases (Hirshleifer & Shumway, 2003; Statman et al., 2006). Overconfidence is the most disputed amongst all the predispositions, measured as the positive distinction between one's confidence and accuracy in decision-making (Toma et al., 2021).

We analyze a sample of American financiers surveyed in the National Financial Capability Research (NFCS) and find that financially overconfident financiers are a lot more most likely to own cryptocurrencies. They are likewise extra likely to take into consideration investing in cryptocurrencies in the future. To show the value of our searchings for, an overconfident financier has two to 3 times greater chances of investing in cryptocurrencies than an investor with far better precision in investment-related decision-making.

How To Protect Your Crypto Assets From Cyber Attacks

Bitcoin, the initial cryptocurrency, has been on a wild experience considering that its creation in 2009. Previously this year, the cost of one Bitcoin surged to over $60,000, an eightfold increase in year. Then it was up to fifty percent that worth in just a couple of weeks. Values of various other cryptocurrencies such as Dogecoin have actually climbed and fallen a lot more sharply, often based just on Elon Musk's tweets.

Bitcoin allowed transactions utilizing just electronic identifications, providing customers some degree of anonymity. While Bitcoin's roller-coaster costs garner attention, of far more effect is the transformation in cash and fund it has actually set off that will eventually influence every one of us, for better and worse.

Why Crypto Prices Are So Volatile

It takes around 10 minutes to validate most deals utilizing the cryptocurrency and the deal charge has gone to a typical of concerning $20 this year. Bitcoin's unpredictable value has actually additionally made it an unviable circulating medium. It is as though your $10 costs could purchase you a beer on someday and a container of fine wine on one more.

While Bitcoin has fallen short in its stated goals, it has actually become a speculative financial investment. This is perplexing.

Bitcoin followers will certainly inform you that, like gold, its worth comes from its scarcityBitcoin's computer formula mandates a fixed cap of 21 million electronic coins (virtually 19 million have been produced up until now). Scarcity by itself can barely be a resource of worth. Bitcoin investors seem to be relying on the better fool theoryall you require to make money from a financial investment is to discover a person happy to purchase the asset at an also greater cost.

Banks have actually mostly remained on the sidelines. Similar to any kind of speculative bubble, ignorant capitalists who concern the event late are at biggest threat of losses. The federal government must absolutely caution retail capitalists that, similar to in the GameStop saga, they act at their own peril. Safety and securities that allow supposition on Bitcoin rates are already controlled, but there is not a lot a lot more the government can or ought to do.

A Beginner’s Guide To Crypto Trading

Such money won't endanger the united state dollar, but could clean out the currencies of smaller sized and much less industrialized countries. Versions of Bitcoin's technology are likewise making many monetary product or services readily available to the masses at reduced cost, directly linking savers and borrowers. These growths and the possibilities created by the new innovations have spurred central financial institutions to take into consideration releasing electronic versions of their own currencies.

While Bitcoin's roller-coaster costs amass attention, of much more effect is the transformation in money and finance it has set off that will eventually impact every one of us, for better and even worse.

Much of the tech is still being created and is not yet extensively verified in real-world scenarios. If so, every task that counts on un-hackable blockchain safety and security will have to create quantum-safe procedures.

How To Protect Your Crypto Assets From Cyber Attacks

While the success of any cryptocurrency project is not ensured, early financiers in a crypto task that reaches its objectives can be richly compensated over the long term. Attaining widespread adoption is needed for any kind of cryptocurrency job to be taken into consideration a long-term success.

That's not to say Ethereum doesn't have competition. A variety of "Ethereum Killers," consisting of (-2.18%), (CRYPTO: POL), and (-5.58%), are constructed to take care of wise agreements and use a blockchain system capable of processing even more deals per secondly. The speed has actually the added advantage of being more economical for customers.

Latest Posts

How To Trade Cryptocurrencies Using Technical Analysis

Top Cryptocurrency Wallets For Maximum Security

The Impact Of Bitcoin Halving On The Market